are political donations tax deductible uk

S34 1 Income Tax Trading and Other Income Act 2005 S54 1 Corporation Tax Act 2009. The simple answer to whether or not political donations are tax deductible is no.

Explore Our Image Of In Kind Donation Receipt Template Receipt Template Donation Letter Template Teacher Resume Template

This website offers information on are donations to political parties tax deductible uk.

. Political donations made by individuals are not tax-deductible in Britain. Donations to charity made by businesses that are claimed as a deduction against trading income must be made wholly and exclusively for the purposes of the business in order for a. BIM47405 - Specific deductions.

Businesses cannot claim deductions for contributions and gifts to political parties members and candidates including payments incurred in deriving assessable income. They may claim Gift Aid to increase the donation to 125. Postby maths Sat Apr 03 2010 357 pm.

It is almost impossible for contributions to political parties to constitute tax deductible items. Gifts of certain kinds of property can have this limitation reduced to 30 or 20 as well as the possibility of higher earners to itemize deductions to 20 under the phase-out rule. While political contributions arent tax-deductible many citizens still donate money time and effort to political campaigns and to.

Are Provincial Political Donations Tax Deductible. Although political contributions are not tax-deductible there is always a limit to the amount that can be contributed to a political campaign. Businesses likewise cannot claim a deduction for political contributions whether theyre pass-through entities or file a corporate return.

You pay Income Tax above the 20 basic rate. The contributions and gifts to independent candidates and members are deductible. Charitable and political subscriptions.

The laws governing political contributions vary by jurisdiction. The same goes for campaign contributions. For instance the UK and USA permit political donations while they are prohibited in Belgium and France.

Reuters is the first to measure the loophole which offers political parties and in some cases individual politicians or their families an unintended gift from the taxpayer. If you made a contribution to a candidate or to a political party campaign or cause you may be wondering if your political contributions are tax deductible. Donations by individuals to charity or to community amateur sports clubs CASCs are tax free.

HMRC does not generally consider this to be the case for political donations although there may be a case to argue in some very limited circumstances. Membership subscriptions affiliations and donations from private parties. To be allowable for tax purposes expenses must be incurred wholly and exclusively for the purpose of the trade.

Tax relief on political donations. Political donations made by individuals are not tax-deductible in Britain. Political Contributions Are Tax Deductible Like.

How Much Political Contribution Is Tax Deductible. If a donor makes money as salary or dividend and then donates it they have to pay income tax. Contributions and gifts to political parties are taxed at 1500.

T2 - Tax Research Network. How Much Political Contribution Is Tax Deductible. In place of the alienationdeduction at.

N2 - Political parties in the United Kingdom are overwhelmingly financed from private sources. 75 percent of the original 200 50 percent of the next 900 and 33 percent of the next 1200 are capped at 1000 per participant. Millions of pounds in donations to political parties a Reuters analysis has found.

T1 - Tax Deductibility for Donations to Political Parties in the United Kingdom. Up to 1000 can be claimed as a tax credit. Donors would not pay the difference between the higher and the basic rate of tax on the donation when using a Payroll Giving scheme.

Tax season is a great time to make political contributions. So enjoy reading the articles on are donations to. Donations made in the United States may generally be tax deductible for up to 50 of their value in any calendar year.

AU - MacLennan Stuart. You can claim your gifts and contributions to registered political parties and independent candidates as tax deductions. In terms of deductibility for trade purposes such contributions cannot satisfy the wholly and exclusively test.

However in-kind donations of goods to qualified charities can be deductible in the same way as cash donations. Paying 40 tax means you would personally claim back 2500 125 x 20. There are three levels of tax credits.

Your political gifts or contributions need to be made in a personal capacity to be tax deductible. The tax implications of political donations are often problematic. This is called tax relief.

Expenditures cash or in kind made directly or indirectly to a political party or its local branches elected officials or political candidates. As tax time approaches political contributions can lead to higher tax rates. The answer is no donations to political candidates are not tax deductible on your personal or business tax return.

Suppose you make a donation of 100 to your favourite charity. The tax goes to you or the charity. Individuals can contribute up to 2800 per election to the campaign committee up to 5000 per year for PAC and up to 10000 per year for local or district party committees.

Regardless of whether a political contribution is made in the form of money or an in-kind donation it is not tax-deductible. Political donations made by individuals are not tax-deductible in Britain. The tax credit will equal up to 75 percent of the first 200 contributed plus 50 percent of the next 900 and 3313 percent of the next 1200.

All contributions are eligible for a credit of either 75 percent for each 200 contributed 50 percent for each 900 donated ercent for the first 200 you contribute 50 percent of the next 900 and 331 33 of the next 1200 to a maximum credit of 1000. You can claim back the difference between the tax youve paid on the donation and what the charity got back when you fill in. Under the Political Parties Elections and Referendums Act 2000 PPERA which governs donations to political parties any contribution of more than 500 must come from a UK-based individual or.

When CT was introduced by FA65 the aim was to create a scheme for a comprehensive new tax on companies which had formerly paid Income Tax and Profits Tax. Expenditures can be for general party.

Pin On Political Posters Worth A Look

Nonprofit Tax Programs Around The World Eu Uk Us

Canadian Tax Return Check List Via H R Block Ca Http Www Hrblock Ca Documents Tax Return Documen Small Business Tax Deductions Business Tax Tax Checklist

Explainer Why Are Donations To Some Charities Tax Deductible

Difference Between Charity Business Administration Think Tank

Why We Need To Stop Talking About Volunteer Programmes Volunteer Programs Volunteer Management Volunteer

Are Donations To Political Parties Tax Deductible Uk Ictsd Org

Complete Guide To Donation Receipts For Nonprofits

Donate Crypto And Lower Your Tax Bill Koinly

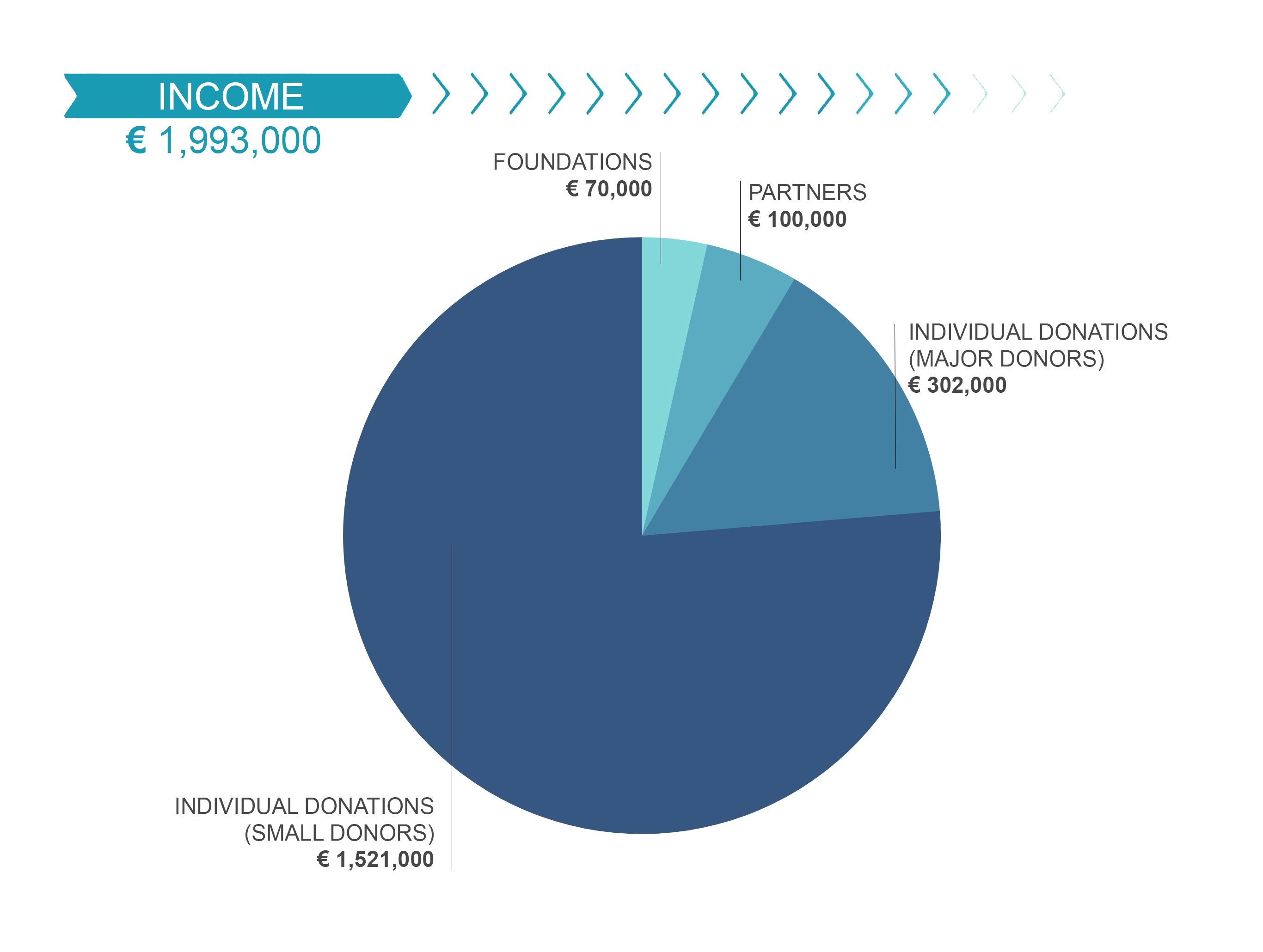

How Much Should You Donate To Charity District Capital

Tax Deductible Donations Can You Write Off Charitable Donations

What Are The Tax Implications Of Giving To Charity

Are Donations To Political Parties Tax Deductible Uk Ictsd Org

New Tax Regime Disincentivises Charity Donations Says Study Business Standard News

Tax Deductions For Donations In Europe Whydonate

Who Gives To Charity Charity Marketing Charity Nonprofit Fundraising